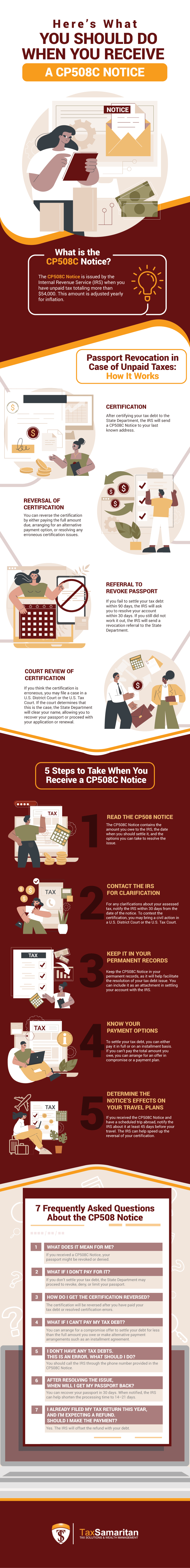

Here’s What Expats Should Do If You Receive A CP508C Notice

Taxes shouldn’t be taken lightly, especially by expats. Because you’re in a foreign country, all the more you have to be extra meticulous in filing your taxes correctly. This infographic will serve as a guide if your tax debt becomes out of hand and leads to passport revocation.

What is the CP508C Notice?

You’ll get a CP508C Notice from the Internal Revenue Service (IRS) when you have a “seriously delinquent” tax debt. This refers to an unpaid, legally enforceable federal tax debt (including interest and penalties) totaling more than $62,000 (adjusted for 2024). This amount is adjusted yearly for inflation.

Before sending the notice, the IRS will certify your tax obligation as a seriously delinquent tax debt. Section 7345 of the Internal Revenue Code (IRC) requires the IRS to notify the U.S. Department of State of individuals who incurred such tax liability.

After getting the certification from the IRS, the State Department will exercise its authority by either revoking your passport or not issuing a new one. If you’re an expat, it may limit your travel to U.S. soil only.

Passport Revocation in Case of Unpaid Taxes: How it Works

Passport denial, revocation, or limitation due to a seriously delinquent tax is authorized by law. As such, the IRS is required to certify that debt to the State Department for action. Here’s how it works:

- Certification

After certifying your seriously delinquent tax debt to the State Department, the IRS will send you a CP508C Notice by regular mail using your last known address. The document is solely addressed to you, so your attorney will not be receiving a copy of it.

- Reversal of Certification

After receiving the CP508C Notice, you can reverse the certification issued by the IRS. The State Department will hold your passport application for 90 days to allow you to resolve the issue by:

- paying the full amount due;

- arranging with the IRS for an alternative payment option; or

- resolving any erroneous certification issues

After you have settled the matter, the IRS will issue a CP508R Notice within 30 days, reversing the certification. Note that the IRS will not reverse the certification if your payment is below the threshold amount.

- Referral to Revoke Passport

If you fail to settle your delinquent tax debt within the specified 90-day period, you will receive Letter 6152 from the IRS asking you to resolve your account within 30 days. If you still did not work it out within that duration, the IRS will send a revocation referral to the State Department.

- Court Review of Certification

If you believe that the certification is erroneous or the IRS failed to reverse the certification when it should have, you may file a case in a U.S. District Court or the U.S. Tax Court.

If the court determines that the certification should be reversed or is erroneous, it can order the IRS to inform the State Department of the error. In turn, the State Department will clear your name, allowing you to recover your passport or proceed with your application or renewal.

5 Steps to Take When You Receive a CP508C Notice

When you get a CP508 Notice, there’s no need to worry. Here’s what you need to do:

1. Read the CP508C Notice

The CP508C Notice contains the amount you owe to the IRS and the date when you should settle it. It also explains the options you can take to resolve the issue and the consequences of failing to do so. Thoroughly read your CP508C Notice so you can be sure you’re looking at things from the right perspective.

2. Contact the IRS for clarification

If you have any clarifications or disagree with the assessed tax specified in your CP508C, you should contact the IRS within 30 days from the date of the notice.

If you’ve already paid the tax debt mentioned in the CP508C Notice, you should send proof of your payment to the IRS. Meanwhile, if you want to contest the certification, you may either call the IRS or bring a civil action in a U.S. District Court or the U.S. Tax Court.

The legal action will determine if the certification was erroneous or if the IRS failed to reverse the certification as required by Section 7345(c) of the IRC. Note, however, that you are not required to contact the IRS before filing a civil case.

3. Keep it in your permanent records

Keeping the CP508C Notice in your permanent records will help facilitate the resolution of your tax debt issue. You can include it as an attachment in settling your account with the IRS through alternative payment arrangements, such as an offer in compromise or an installment agreement.

For an installment agreement, you will be asked to accomplish Form 433-D. Meanwhile, if you opt for an offer in compromise, you need to fill out Form 656. These are IRS files that conform to the IRS Section 508 compliance policy.

4. Know your payment options

In settling your tax debt, you have two options: pay it in full or on an installment basis. If you can’t pay the total amount you owe, you can ask for alternative payment schemes, such as an offer in compromise or a payment plan.

A payment plan is an agreement with the IRS to pay the taxes due within an extended timeframe. You should opt for this if you believe you can pay your taxes in full within the given time.

Meanwhile, an offer in compromise allows you to settle your tax deficiency for less than the full amount you owe. This may be an appropriate option if you can’t pay your total tax liability or if doing so will result in financial hardship. In granting this, the IRS will consider your ability to pay, income, and expenses.

5. Determine the notice’s effects on your travel plans

If the State Department revokes your U.S. passport or denies your U.S. passport application, it will notify you in writing. If you’re leaving soon for international travel and received the notice, you should inform the IRS about it at least 45 days before your scheduled trip. The IRS can help speed up the reversal of your certification.

When expedited, the IRS can shorten the 30 days processing time to 14–21 days. You just need to provide the following documents:

- Proof of travel – This can be a flight itinerary, cruise ticket, international car insurance, hotel reservation, or any other document showing the location and date of your travel or time-sensitive need for your passport

- A copy of the letter from the State Department revoking your passport or denying your passport application

7 Frequently Asked Questions About the CP508C Notice

Here are some commonly asked questions regarding the CP508C Notice:

1. What does it mean for me?

If you received a CP508C Notice, your passport might be revoked, or your passport application might be denied. If you’re an expat, you may be issued a limited validity passport, which is good only for direct return to the United States.

2. What if I don’t pay for it?

If you don’t settle your tax debt, the IRS will proceed to certify your tax debt to the State Department. Upon receiving the certification from the IRS, the State Department will revoke, deny, or limit your passport.

3. How do I get the certification reversed?

The IRS will reverse the certification after you have paid the tax debt in full or partially through an alternate payment arrangement or have resolved certification errors, whichever applies in your case.

4. What if I can’t pay my tax debt?

Among your many options, you can arrange for a compromise offer to settle your debt for less than the full amount you owe.

If you have declared bankruptcy or when the IRS has determined that your account is not currently collectible due to financial incapacity, your certified debt will no longer be considered seriously delinquent, Therefore, your passport will not be revoked.

5. I don’t have any tax debts. This is an error. What should I do?

If you think the certification was made in error, you should call the IRS through the phone number provided in the CP508C Notice.

6. After resolving the issue, when will I get my passport back?

Once you’ve resolved your tax issue, the IRS will reverse the certification in 30 days. When notified, it can help speed up your passport’s approval and shorten the processing time to 14–21 days.

7. I already filed my tax return this year, and I’m expecting a refund. Should I make the payment?

Yes. The IRS will offset the refund with your debt. If the refund is enough to cover your tax debt, the IRS will reverse the certification and consider your account fully paid.

Dealing with Your Passport Revocation

If you receive a CP508C Notice, there’s no need to fret. There are ways to resolve the matter and get your passport back. Just be sure to read the notice thoroughly and call the IRS to clarify your concerns.

If you need assistance regarding passport revocation by the State Department, Tax Samaritan offers top-of-the-line tax services for expats.