Urgent Things You Need to Know About Filing Taxes When Married to a Foreign Spouse

Tying the knot with a significant other is the ultimate step in a relationship. However, aside from having a romantic partner to spend the rest of your life with, getting married also gives you more options to save on taxes. If you want to know how to file taxes when married to a foreigner, here is a step-by-step process to guide you and your spouse.

How to File Taxes When Married to a Foreign Spouse

Step 1: Determine your spouse’s residency status

If your spouse is a U.S. citizen, then the process of filing taxes in the U.S. will apply. Whether spouses live in the U.S. or another country, the IRS will require them to declare all their income.

Here, the major advantage is that you and your significant other will have the ability to file joint taxes, giving you a substantial tax standard deduction. If you’re willing to go through a considerable amount of paperwork, this is an excellent strategy to cut down on your taxes.

However, filing taxes may be more complex when you are married to a foreigner. Although, you still have viable options. First, your partner who doesn’t have American residency can declare a resident alien status for tax-filing purposes. Like a U.S. citizen whose spouse has a green card, you and your partner will have a higher standard deduction and may pay less in total taxes. However, if your non-resident alien spouse has income, it may mean that you pay more in taxes.

Another thing to remember is a nonresident alien partner who earns and spends money outside the U.S. is not oblige to file taxes with the IRS. However, if you file a joint return with a nonresident alien partner, then they become obligated to file and pay taxes to the IRS.

Read: 6 Steps to Determine Your Tax Residency Status

Step 2: Ask your spouse to get an SSN or ITIN

If you and your spouse decide to file your taxes together, you must have either a Social Security Number (SSN) or an International Taxpayer Identification Number (ITIN). To secure an SSN, you must be eligible. If so, complete Form SS-5 and submit it to any Social Security office.

Your spouse from a foreign country can submit the SS-5 at a consulate or the U.S. embassy. If you cannot get an SSN, an alternative solution is to get an ITIN.

Read: Important Facts to Know When Applying for an ITIN

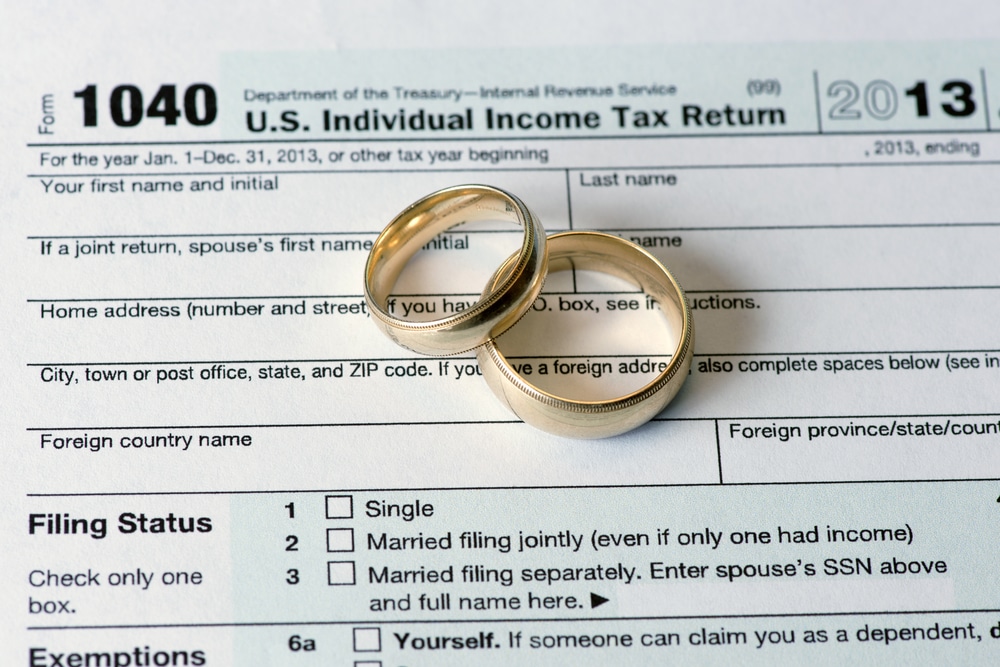

Step 3: Choose the correct filing status

Before choosing a tax filing status, you must know its various benefits and drawbacks, as your filing status can impact your tax liabilities. Here are the filing statuses available to expats with a foreign spouse and their pros and cons, along with pointers on when you should choose one over the other.

-

Married Filing Separately

The default filing status for a U.S. citizen is married filing separately. This means your expat spouse’s earnings do not qualify for U.S. tax filing purposes. If you choose this filing status, your significant other will not have to file for a U.S. tax return. In this filinf, the IRS will not consider your spouse’s income, sparing you from additional income taxation.

Filing taxes separately may be advantageous for U.S. citizens with spouses earning considerably more in other countries. However, the biggest drawback of married filing separately is that you will not enjoy the same tax deductions, benefits, and credits afforded to married people who file jointly.

-

Married Filing Jointly

Married filing jointly with a non-U.S. resident can afford couples a significant standard tax deduction. Joint filing is an ideal filing status if your expat spouse doesn’t earn that much. Thus, granting both of you substantial credits and deductions.

While there are benefits to married joint-filing, the biggest drawback is that you may owe additional taxes.

Can I File Single Even If I’m Married?

No, married expats cannot file single anymore. Once married and living with a spouse, filing as a single or head of household is no longer an option. However, you can still choose between a married filing separately or married filing jointly status.

Step 4: Check your eligible tax credits and deductions

It’s possible to earn credits for foreign tax, child and dependent care, retirement savings contributions, and other categories. Granted, a nonresident alien spouse should present proof of U.S. income. Checking the IRS Publication 519 will give you more insight into tax credits.

Help With Filing Taxes When Married to a Foreigner

Filing taxes when married to a foreigner can provide many benefits. However, it also brings slight complexities, which require careful planning to maximize a particular option. If you’re an expat with a non-U.S. citizen spouse, enlisting the help of a tax expert, like Tax Samaritan, allows you to figure out the best tax strategy for reducing your tax dues.

Tax Samaritan has served expats since 1997, helping clients understand and comply with intricate tax laws through tax preparation services.