A Guide on How To Make Tax Payments for Expats

Are you an American who is now living or working in another country? If so, then you should know that you have a lifelong responsibility as a U.S. citizen to file your Federal Tax Returns. Taxes can be complicated for U.S. expats, especially when you’re clueless about where to begin. The process can be quite daunting at first. However, once you know and understand the entire process, including the IRS tax payment methods and payment plans, you’ll realize it’s not an impossible task.

This infographic will walk you through the different tax payment options for expats. Read through to learn the basics of expat taxes.

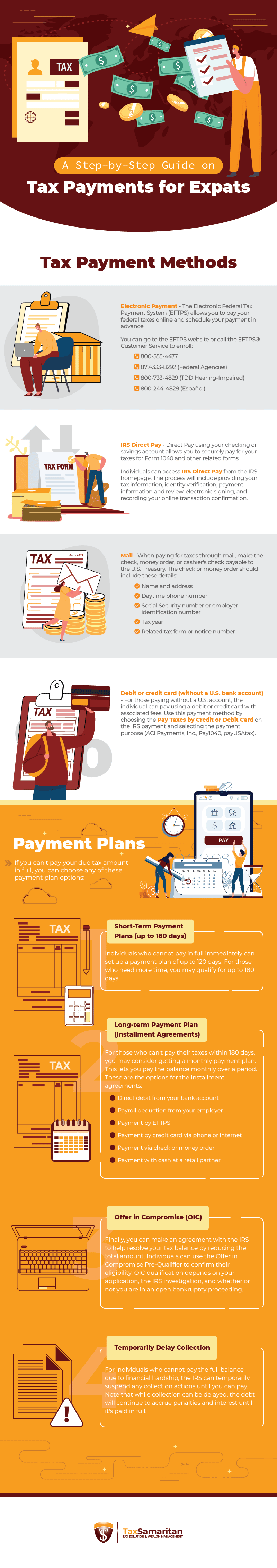

Tax Payment Methods

Paying your taxes late comes with hefty interest and monthly late payment fees. Therefore, paying on or before the filing deadline is crucial to avoid these charges. Here are the different payment options you can try to pay your dues that work even when living abroad.

Electronic Payment

The Electronic Federal Tax Payment System® (EFTPS) tax payment system is a free service from the U.S. Department of Treasury. Individuals can enroll their account through the service to pay their federal taxes to the IRS. They can also schedule payments in advance, track their payments via email notifications, pay taxes online, and view 16 months of payment history, among others.

To enroll in EFTPS, you can visit the EFTPS page and click Enrollment. Follow the instructions to complete the enrollment to log in and proceed to make a payment. You can also call the EFTPS® Customer Service to request an enrollment form. Here are the numbers to take note of:

- 800-555-4477

- 877-333-8292 (Federal Agencies)

- 800-733-4829 (TDD Hearing-Impaired)

- 800-244-4829 (Español)

IRS Direct Pay

The IRS Direct Pay is another free tax payment service that allows Americans to pay their Income Tax Form 1040 online directly from their bank accounts.

What makes IRS Direct Pay different from EFTPS is that the latter is mainly used for business payments or frequent payments. Direct Pay is a convenient and faster option if you need to make immediate payments since registration isn’t required and you have never tried EFTPS.

Here’s how you can get started with Direct Pay.

- Go to the main Direct Pay page.

- Select the Make a Payment option.

- Choose the reason for your payment, how it will be applied, and the tax year you’re paying for.

- Proceed to fill in the information needed on the next steps and confirm your payment.

You can refer to the IRS Direct Pay Additional Information page to learn more.

If you prefer to proceed with your tax payment through the mail, you can do so by making a check, money order, or cashier’s check payable to the U.S. Treasury. The IRS recommends not to send cash through the mail. The money order should include the following details:

- Name and address

- Daytime phone number

- Social Security number or employer identification number

- Tax year

- Related tax form or notice number

Mail your payment to the correct address. You may refer to this page to file paper Individual Tax Returns. Do not use staples or paper clips for your mail.

For more information about paying your balance by mail, check out the IRS Pay by Check or Money Order guide. Make sure to consider the other options before making a payment through the mail.

Debit or credit card (without a U.S. bank account)

If you don’t have a U.S. bank account, you can still make debit or credit card payments. The IRS utilizes third-party systems with this option, so expect to pay associated fees. Here are the steps to pay your taxes through credit card or debit:

- Go to the Pay Your Taxes by Debit or Credit Card page.

- Choose the Pay1040 option and click the Make a Payment button.

- Complete the information required on the Tax Form.

- Review your information, ensuring all details are correct, then submit your payment.

- You can download your payment receipt for documentation.

Tax Payment Plans

The IRS offers payment plans for individuals who cannot close their tax payments in full. Regardless of the reason, keep in mind that this doesn’t relieve you of your tax responsibilities. It will still accumulate over time but with a manageable payment schedule for you.

1. Short-Term Payment Plans (up to 180 days)

Individuals who cannot pay their tax due in full immediately can set up a short-term payment agreement that allows you to arrange a plan of up to 120 days at this time. Additional time of up to 180 days may be permitted if you qualify. You can be eligible to apply for this if you owe no more than $100,000 in combined tax, penalties, and interest.

Note that there will be penalties and interest until you pay the balance in full. You can arrange a short-term payment plan through the Online Payment Agreement (OPA) application or by calling customer service at 800-829-1040.

2. Long-term Payment Plan (Installment Agreements)

For those who cannot pay taxes within 180 days, you may look into setting up a monthly payment plan. This allows you to pay the total amount monthly over a certain period. You qualify for this option if you owe $50,000 or less in tax, penalties, and interest and managed to submit all necessary returns. These are the payment options for installment agreements:

- Direct debit from your bank account

- Payroll deduction from your employer

- Payment by EFTPS

- Payment by credit card via phone or internet

- Payment via check or money order

- Payment with cash at a retail partner

You can request a payment plan through the OPA application. You will need to accomplish Form 9465 and Installment Agreement Request, then mail the paperwork to the IRS.

3. Offer in Compromise

An Offer in Compromise (OIC) lets you make an agreement with the IRS to resolve your tax liability by reducing its total amount. Individuals may be considered for an OIC if they have filed all their returns, completed the required estimated tax payments for the current tax year, and submitted all necessary federal tax deposits for the current quarter (for business owners with employees).

You can use the Offer in Compromise Pre-Qualifier tool to confirm your eligibility. While using the tool won’t immediately grant you an OIC, this will help the IRS see the full picture of your application and conduct their investigation more accurately.

4. Temporarily Delay Collection

If you cannot pay the full balance due to financial hardship or the tax amount affecting your basic living expenses, the IRS can suspend any collection actions until you can pay. The IRS can report your account as currently not collectible temporarily.

To approve your request to delay the collection, the IRS may ask you to accomplish a Collection Information Statement (Form 433-F, Form 433-A, or Form 433-B) and require you to provide proof of your financial status (i.e., monthly income and expenses, assets). Note that while collection can be delayed, the debt will continue to accrue penalties and interest until it’s paid in full.

Basic Guide to U.S. Expat Taxes

Below is a guide on what taxpayers living abroad should keep in mind in order to fulfill their tax responsibilities.

1. Know when to file

The tax deadline for U.S. citizens abroad is June 15. They automatically get a 2-month extension to file their tax return and federal income tax if they’re also on the regular deadline of their return.

2. Learn about the tax forms you need to submit

Filing taxes for expats can be complex with the number of forms they need to complete and submit. You need to know which forms are necessary in order to ensure your documents are complete and your taxes get processed faster. Here are some of the forms you need to keep in mind:

- Form 1040: This reports your name, Social Security numbers, and address.

- Form 2555: Also known as the Foreign Earned Income Exclusion (FEIE), this calculates the earned income exclusion allowed on your tax return.

- Form 1116: The Foreign Tax Credit (FTC) form calculates how much can be reduced to your U.S. taxes if you pay them to your country of residence.

3. Know where to file

You can mail your tax return to:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

USA

On the other hand, taxpayers overseas with an Adjusted Gross Income (AGI) within a specified threshold can file their return for free through Free File.

4. Get caught up on your taxes

Whenever possible, make sure to pay your tax dues on or before the deadline to avoid interest and penalties. However, you can always request a payment plan if you can’t pay in full and pay your dues online for a more convenient transaction, as listed above.

5. File with an advisor

There may be forms you will need to complete but aren’t aware of. Working with a professional tax advisor can help you fulfill your tax requirements to ensure you’re all caught up with your forms and payments.

Summing It Up

Living and working abroad opens a lot of opportunities. But you shouldn’t forget about your tax obligations as a U.S. citizen. With adequate knowledge about tax provisions for expats, you can potentially receive significant tax benefits.

Know the tax implications that come with becoming an expat. If you’re unsure where to start as well as how to sort out the proper tax documentation, you can reach out to Tax Samaritan for tax resolution services and get expert advice. Have your tax needs and concerns answered when you consult with our team of tax professionals.