Foreign Earned Income Exclusion For Self-Employed Expats — What Expat Need To Know

If you’re an expat living and working abroad, you may have heard about the foreign earned income exclusion (FEIE). But do you know that it doesn’t only benefit corporate-employed expats? In fact, freelancing and self-employed expats can also benefit from this tax deduction.

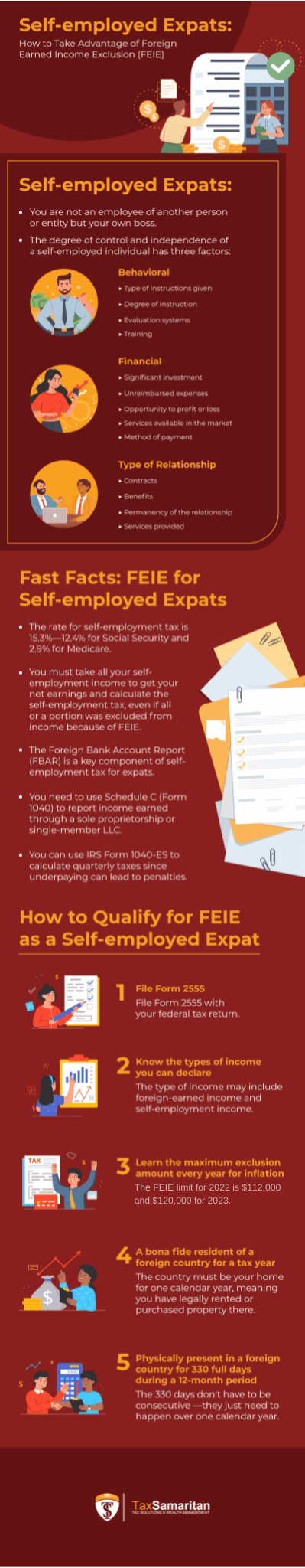

How does FEIE work? And how can you take advantage of it? If you’re a self-employed expat who wishes to maximize your tax deductions, this infographic will provide a comprehensive overview of Foreign Earned Income Exclusion and how to take advantage of it.

Self-employed as Defined by the IRS

Being self-employed means you’re your own boss—you’re not employed by another person or entity. You get to decide how much you make and what you do with your time. But that also means you’re accountable for any tax liabilities for your business.

The IRS defines self-employment as working for yourself, whether as a sole proprietor, partnership, or corporation. If you’re an independent contractor, you’re also considered self-employed. The IRS additionally has three criteria to determine what constitutes “independent contractor” status:

1. Behavior

The first indicator of independence is behavior. Employers typically give instructions to their employees. If you are self-employed, a business will not prioritize giving specific details to you but focus on the results you provide.

Employers also usually provide less training to independent contractors. Regular employees do get more training, which is why businesses can target how they work. For the self-employed, the results matter most.

2. Financial

The next indicator is the financial aspect. A self-employed person often invests in their equipment, and depending on the job, there are no limits in expanding to fulfill work.

This relates to why independent contractors usually are unreimbursed for their expenses. There are costs incurred regardless if the work is essential or not. Thus, there are times when the self-employed lose more money than they earn because of their investment.

3. Type of Relationship

Finally, the type of relationship matters when defining an independent contractor. Typically, contracts should state whether you are an employee or an independent contractor. However, the IRS isn’t required to follow what is in agreement regarding your work status—how the relationship works determines that.

What about benefits like sick leaves, vacation leaves, and pension plans? For self-employed people, businesses tend not to grant these benefits. But their absence also doesn’t mean that a worker is self-employed.

If workers have an indefinite relationship with the business, they are more likely to be regular employees. For independent contractors, the relationship lasts for as long as the project period, thus, the lack of benefits.

Foreign Earned Income Exclusion for Self-employed Expats

The FEIE is a tax benefit that excludes your income earned in a foreign country from your gross income. This means you don’t have to pay any income tax on it.

You can qualify for the FEIE if you meet either the Bona Fide Residence Test or the Physical Presence Test. If eligible under the Physical Presence Test, you must file Form 2555 with your tax return, even if your total foreign earned income and housing amounts are below the filing threshold.

But what if you’re a self-employed worker? Below are five facts on how FEIE works for self-employed expats.

1. The rate for self-employment taxes is 15.3%

If you’re self-employed, you’ll be subjected to self-employment taxes (unless you qualify for an exclusion under a totalization agreement and have a “Certificate of Coverage” to attach to your return) on your net earnings. If your gross income exceeds the limit, you must pay income tax on the portion of your income exceeding the limit. Self-employment tax is due on the net profits from self-employment without deduction for excluded foreign earned income.

2. Account for all self-employment income

When calculating your net earnings for self-employment tax, it’s crucial to account for all your self-employment and business income, even if it’s not a significant source.

3. The Foreign Bank Account Report (FBAR) is a key component of self-employed taxes for expats

You must submit an FBAR when you have a financial interest in or signature authority over at least one foreign financial account. The report can identify taxpayers who may be using offshore accounts to evade taxes. Even if you don’t owe any taxes, you must complete the form and submit it on time.

The IRS will use the information to determine whether you need to file Form 8938 with your tax return. You can face additional tax liability if you fail to correctly report all your foreign assets.

4. Using Schedule C (Form 1040) to report income

Expats who earn income through a sole proprietorship or single-member LLC need to use Schedule C to report their income. Schedule C is one of the most important forms for expats because it allows them to claim some tax deductions and credits. Expats can claim self-employment taxes, which they can use to offset income from the business.

5. Using the IRS Form 1040-ES to calculate quarterly taxes

Expats who live and work abroad can use IRS Form 1040-ES to calculate their quarterly taxes since underpaying can lead to penalties.

This form helps expats pay the right amount of taxes on that income. Not filling out the form could mean late fees, penalties and interest if underwithholding.

How to Qualify for Foreign Earned Income Exclusion as a Self-employed Expat

Now that you know how the FEIE works for self-employed expats, you can now check your eligibility for it before filing your taxes.

1. File Form 2555

You can file Form 2555 to qualify for Foreign Earned Income Exclusion (FEIE). File it as part of your federal tax return and get a refund if any taxes are due on your foreign-earned income.

2. Know the types of income you can declare

There’s a lot to consider when it comes to the FEIE for self-employed expats. You have to be careful about what you can claim, or else you might not qualify in the first place. You need to know what types of income you can declare. These include foreign-earned income, self-employment income, foreign tax home, and many more.

3. Learn the maximum exclusion amount every year

Why is it important to keep track of the FEIE limit each year? The answer is simple: inflation.

The FEIE limit for 2022 is $112,000 and will increase to $120,000 for 2023. If your income is below the exclusion limit for the year, you can claim the FEIE on your taxes and avoid paying income taxes on your foreign-earned income. This is a great way to save on taxes if you live abroad.

4. Be a bona fide resident of a foreign country for an entire tax year

If you want to qualify for the FEIE as a self-employed expat, you must be a bona fide resident of a foreign country for an entire tax year. An individual would be a bona fide resident if they were “physically present” in that country on a “regular basis.” You are physically present if you live in the country for the entire duration of a tax year.

In addition, you must show that you had no intention of returning to your home country during the period of residence.

5. Physically present in a foreign country for at least 330 days

Being physically present in a foreign country for at least 330 full days during any 12-month period is part of meeting the Physical Presence Test. The 330 days don’t have to be consecutive—they just need to happen over one calendar year.

The difference between this and bona fide residence is that this test can be adjusted over two years. You must have spent the whole 330 days in the foreign country because partial days like in the case of traveling don’t count. Keep track of the days spent in the country to make the process easier.

Take Advantage of Foreign Earned Income Exclusion

There’s no denying that dealing with taxes can be a hassle. Regardless if you’re an expat independent contractor or a regular employee, it’s important to know the process behind filing taxes to avoid penalties and other issues with the IRS. As a self-employed expat, the FEIE is there to help lighten the load by reducing taxes from your income, so it’s best that you check it out.

If you are looking for someone to help you with tax resolution services, Tax Samaritan is the partner you need. The team offers the best-in-class services from compliance, planning, and representation. For more information, visit our website today.