The Peril of Ignoring Estimated Quarterly Tax Payments for Expats: How to Avoid Penalties

If you’re a freelancer or small business owner, the danger of neglecting estimated quarterly tax payments looms large over your financial stability. When you’re caught up in meetings, deadlines, and dealing with clients, it’s easy to forget about the tax responsibilities. The IRS requires individuals with income not subject to withholding, like freelancers and business owners, to make these payments throughout the year. Ignoring these payments, however, can lead to serious consequences.

What Are Estimated Quarterly Tax Payments?

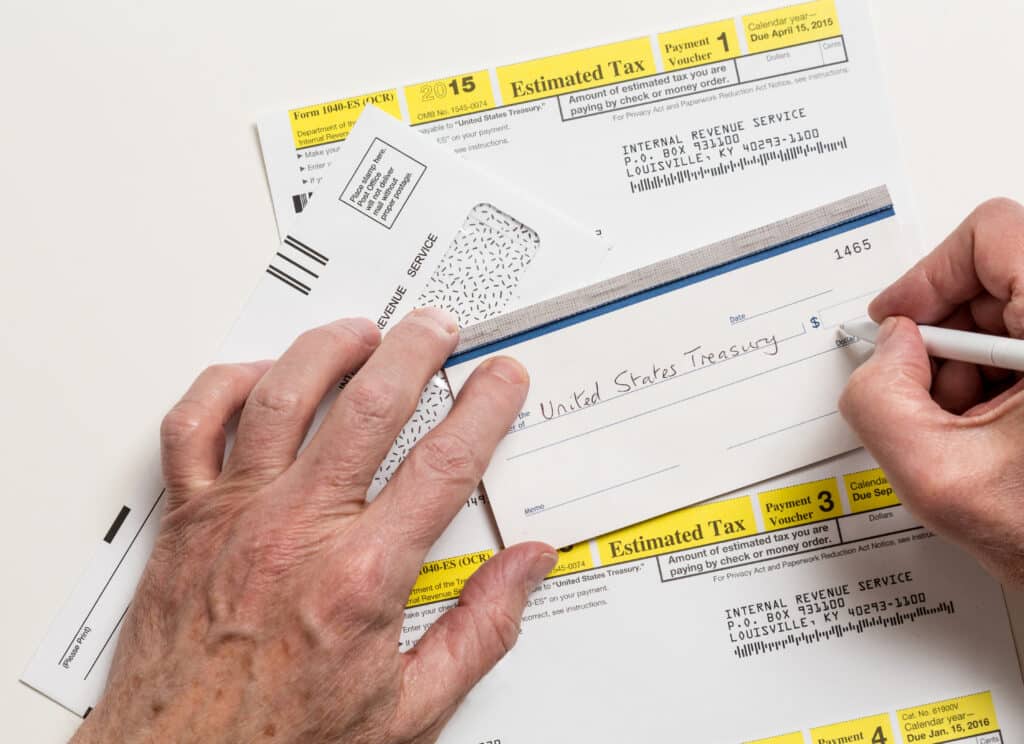

Estimated quarterly tax payments allow self-employed individuals and business owners to pay their taxes on income that is not subject to withholding. This includes income from self-employment, rental income, and investment gains. Instead of having taxes deducted from each paycheck, as employees do, freelancers, gig workers, and business owners are responsible for calculating and paying their taxes on a quarterly basis, typically in April, June, September, and January.

Who Needs to Pay Estimated Quarterly Taxes?

The requirement to pay estimated quarterly taxes applies to various individuals, including freelancers, consultants, sole proprietors, and anyone with substantial income not subject to withholding. If you expect to owe $1,000 or more in taxes after subtracting your withholding and refundable credits and you expect your withholding and credits to be less than the smaller of

- 90% of the tax to be shown on your current year’s tax return or

- 100% of the tax shown on your prior year’s tax return (if your prior year’s return covers 12 months, not applicable if you have no prior-year tax return),

then you should consider making estimated quarterly tax payments.

Why Ignoring These Payments Can Hurt You

When you don’t make the required estimated quarterly tax payments, the IRS considers it underpayment. They calculate the penalty for underpayment based on the amount owed and the number of days the payment is overdue. In addition to penalties, interest accrues on the unpaid amount. This means that the longer you delay, the more you’ll owe.

Making timely and accurate estimated quarterly tax payments helps you avoid these unnecessary financial hits.

How to Calculate Your Quarterly Payments

Calculating your quarterly estimated tax payments doesn’t have to be a complex equation. In fact, the IRS provides a straightforward method for determining the amount you owe. Here’s a simple guide to help you through the process:

- Estimate Your Annual Income. Start by estimating your total income for the year. Consider all sources, including self-employment income, freelance earnings, and investment income.

- Determine Your Deductions. Subtract any eligible deductions to arrive at your adjusted gross income (AGI). This includes business expenses, education expenses, and other deductible items.

- Calculate Your Tax Liability. Calculate your estimated tax liability for the year using the tax brackets for your filing status. This is the amount you would owe if you were to pay your taxes in a lump sum.

- Divide by Four. Divide your estimated tax liability by four to determine your quarterly payment amount. This simple step ensures you’re making equal payments throughout the year.

- Adjust for Changes. Adjust your estimated quarterly tax payments accordingly if your income or expenses change during the year. Regularly reviewing and updating your estimates helps you stay on course.

Practical Tips to Avoid Tax Penalties

- Set Reminders for Payment Due Dates

The first step in avoiding the danger associated with quarterly tax payments is to set up reminders well in advance. Mark the payment due dates on your calendar and utilize digital tools that send you alerts.

- Estimate Accurately

Take the time to estimate your annual income accurately. Underestimating can lead to insufficient payments, while overestimating means you’re giving the IRS an interest-free loan. Striking the right balance is key.

Use the Electronic Federal Tax Payment System to make your payments conveniently and on time.

Navigating Quarterly Obligations With Confidence

The danger of neglecting estimated quarterly tax payments is real, but it’s a danger you can actively avoid. Take the time to understand your financial situation, use the IRS guidelines, set reminders, and consider professional help if needed. Actively staying on top of your tax obligations will keep the IRS at bay.

At Tax Samaritan, we’re here to make your journey through estimated quarterly taxes hassle-free. Wondering if you need to pay estimated taxes and, if so, how much? We’ve got you covered.

Our mission at Tax Samaritan goes beyond being tax preparation and representation experts; we strive to be your valued business partners. Understanding that every tax situation is unique, we offer a personal approach to provide realistic and effective solutions tailored to your needs.

Ready to Get Started?

Click below for a free, no-obligation Tax Preparation quote, or call 775-305-1040 to schedule a free 15-minute consultation to discuss your situation. At Tax Samaritan, we’re not just here for your taxes – we’re here for you.