A Primer on How to Invest as an Expat in a Foreign Country

Today, there are two common approaches to making money. One way is by generating income through employment, whether that be working for yourself or someone else. Another is by strategically placing your wealth in an investment, such as stocks, real estate, small businesses, or a combination of all, to increase its value over time.

For U.S. expats living and working abroad, investing is a sound choice to grow their assets exponentially. However, apart from diversifying stock allocations to develop a more efficient portfolio, they need to frequently brush up on their compliance knowledge, as some tax implications can eat up their investments.

If you’re a U.S. expat on the lookout for ways to maximize your true earnings potential, let this infographic be your guide on how to invest in a foreign country effectively.

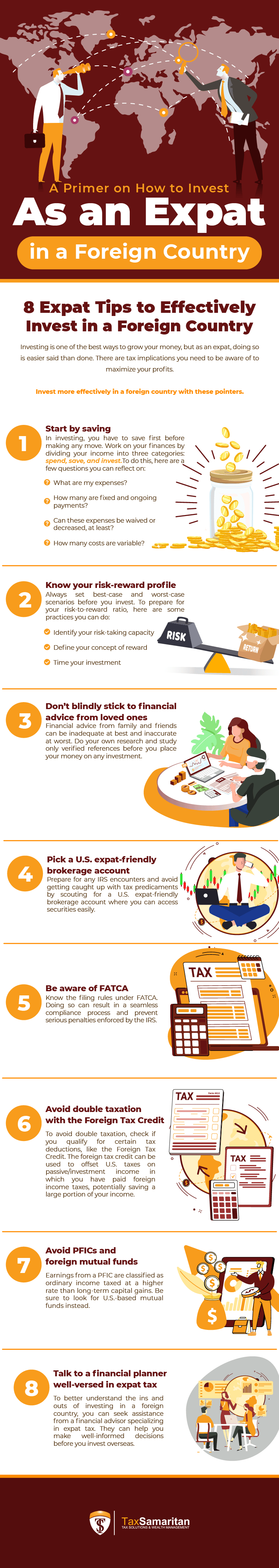

8 Expat Tips to Effectively Invest in a Foreign Country

Dealing with investments is easier said than done, especially for U.S. expats. To help you get started, here are some tips that can help you manage your foreign investments more effectively.

-

Start by saving

For any form of investment, you need funds to make a move. After all, you can’t work with what you don’t have. So, whether you’re a U.S. expat or not, be sure to save first before you invest.

To better handle your finances, categorize your income into three groups: spend, save, and invest. How much money you need to spend depends on your lifestyle essentials and preferences, which is why it’s vital to assess your spending habits, set a weekly or monthly budget, and stick to it. To do so, here are a few questions you can reflect on:

- What are my expenses?

- How many are fixed and ongoing payments?

- Can these expenses be waived or decreased, at least?

- How many costs are variable?

After getting your spending budget straight, you can now determine how much you can allocate for savings. However tempting it may be to spend it on nice-to-haves, try to use it only for emergency purposes. This way, you can place the rest of your income on investments.

-

Know your risk-reward profile

Self-awareness is key before making any investment, especially in a foreign country. Besides setting your spending, saving, and investing allocations, understand your risk-to-reward ratio and prepare by doing the following:

- Identify your risk-taking capacity. Before playing the investment game, ask yourself how much financial loss you can tolerate if, for instance, your investment ever gets wiped out in currency rate fluctuations.

- Define your concept of reward. As an expat investor, you need to consider your definition of risks and rewards to set your expectations accordingly. Would you be content with a low-risk and low-reward type of investment, or would you be more willing to engage in a high-risk kind to bet for higher returns?

- Time your investment. The investment market is ever-changing, which is why it’s important to keep tabs on the industries you want to venture into. Consider a timeline for your purchase, one where the price is at its most reasonable tag and where its current demand will bring significant returns even in the future.

If you’re thinking about placing your money on tradable assets, don’t forget to set your transaction limit. List best-case and worst-case scenarios for the investment and let this be your “trading range” to avoid overinvesting.

-

Don’t blindly stick to financial advice from loved ones

While it’s normal to pick out a thing or two from your family and friends’ stories, their financial recommendations can be inadequate at best and inaccurate at worst.

When engaging in any investment, you want to make sure you’re strategically putting your hard-earned money based on expert advice. Even if you can always count on some of your personal or professional connections, they may or may not have the expat investment expertise to help you grow your wealth.

A thorough scroll on the web can get you numerous sources to kickstart your research on the matter. Filter through and take notes from reliable references. With verified information on hand, you’ll have a better idea of how to manage and invest your foreign source income best.

-

Pick a U.S. expat-friendly brokerage account

Apart from researching how to get started with foreign investments, the next thing you should look into is a brokerage account. This type of account lets you access securities, such as stocks, bonds, and mutual funds, through a broker who acts as a middleman between you and the investments you’re eyeing to purchase.

Much like a typical bank, a brokerage account allows you to transfer money, but it has special tax and withdrawal rules, making it known as a “taxable account.” As an American expat, you know that the Internal Revenue Service (IRS) will be involved, as tax is, too.

To prepare for any encounters with the IRS and prevent risks of getting your account shut down, choose a firm that offers U.S. expat-friendly brokerage accounts. Doing so can save you the stress from tax predicaments that come with the complications of investing abroad.

-

Be aware of FATCA

While the investment game itself has plenty of rules and regulations, expat investments take it up a notch by having strict legislation they need to comply with. For Americans residing overseas, there’s the Foreign Account Tax Compliance Act (FATCA).

Passed into ordinance in 2010, FATCA is part of the Hiring Incentives to Restore Employment (HIRE) Act that requires all U.S. citizens at home and abroad to submit annual reports on any foreign account assets.

This set of rules is a primary response to the 2009 UBS off-shore banking scandal, which revealed that many Americans skip reporting or paying U.S. taxes due on secret Swiss bank accounts containing large financial holdings.

FATCA aims to promote transparency in the global financial services sector, creating new self-reporting requirements to increase tax compliance among U.S. expats with investments held outside of the country.

As a taxpayer and a future overseas investor, you must know the filing rules under FATCA. Now, more than ever, failure to fully comply can result in ratcheted-up penalties.

-

Avoid double taxation with Foreign Tax Credit

To avoid double taxation, check if you qualify for certain tax deductions, like the Foreign Tax Credit. The foreign tax credit can be used to offset U.S. taxes on passive/investment income in which you have paid foreign income taxes, potentially saving a large portion of your income.

-

Avoid PFICs or foreign mutual funds

A Passive Foreign Investment Company (PFIC) is a non-U.S. corporation or entity where 75% or more of its gross margin is categorized as passive income or at least 50% of its assets produce passive income.

As part of being subject to strict tax guidelines by the IRS, distributions from PFICs are considered ordinary income, which gets taxed at a higher rate than long-term capital gains. Because of this catch, as an American expat, you might want to avoid placing your money on this type of investment.

Instead, look for opportunities in U.S.-based investment markets. If you’re working and living in a developed area, check out the local scene as they may offer compelling investment avenues targeting American expats. You can also look into U.S. assets through a local brokerage, one that can grant you access to global markets.

-

Talk to a financial planner well-versed in expat tax

If researching just isn’t your strongest suit and you can’t keep up with the latest laws in the field, you can always seek assistance from a trusted financial planner. Look for someone who specializes in working with expats for the ins and outs of investing in a foreign country.

Partnering with an advisor can help you find the best investment avenues your assets can take part in. Moreover, they can give you a rundown of your specific tax responsibilities and pointers on dealing with liabilities more effectively.

This includes keeping you updated on any new investment policies from your home and resident country to avoid any illegal conduct in the process.

You want to make well-informed decisions regarding your foreign investments as an expat so you can get more gains than losses, and a tax expert on your side can make that possible.

Make Your Expat Investments as Seamless as Possible

The primary rules of investing are already overwhelming on their own. As a U.S. expat, it’s even more complicated because of all the compliance rules—both from your home and foreign country—you have to keep in mind.

Hiring a professional financial advisor with experience in expat tax can help you with the dos and don’ts in the field, ultimately assisting you in making the most out of your investments.

If you’re looking for one to partner with, check out Tax Samaritan. We are a professional tax service provider, helping expats grow their wealth since 1997 through our quality tax resolution services and wealth management services. Get in touch with us to learn how we can make investing in a foreign country as easy as possible.