CP05A Notice – Urgent Things You Need to Do to Claim Your Refund

A dreaded letter from the IRS has arrived – a CP05A notice. Holding it in your hand, your heart skips a beat, and countless…

A dreaded letter from the IRS has arrived – a CP05A notice. Holding it in your hand, your heart skips a beat, and countless…

How would you feel when you open your mailbox and find a collection letter from the IRS instead of the typical mix of bills…

Receiving a Notice of Tax Deficiency can happen to anyone. Check out this article to know what a tax deficiency is and why you should pay attention to it.

Discrepancies in your tax account can get you an IRS notice. Read here to know how to respond to an IRS notice of deficiency and keep your taxes in order.

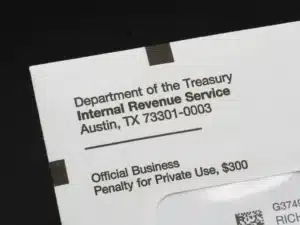

Receiving an IRS audit letter can be a stressful experience. But, how will you know it’s an authentic letter? Learn how to spot a fake IRS letter.

IRS notices are sent for various reasons. Learn more about those grounds in this article.

The IRS sends millions of letters and notices to taxpayers for a variety of reasons. An IRS notification or letter can be easily dealt…

Copyright © 2025 Tax Samaritan | All Rights Reserved | Privacy Policy

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Workflow Excellence Manager will lead the client service experience at Tax Samaritan. This role ensures clients receive unparalleled communication, seamless service delivery, and exceptional care aligned with our commitment to proactive and personalized tax solutions for U.S. expats.

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Transformation Success Manager plays a key role in delivering exceptional client experiences by building strong relationships and offering value-driven tax advisory and financial planning. This role ensures clients receive proactive, strategic guidance to achieve long-term financial success.