5 Tax Advantages of an LLC: How It Can Save You Taxes

You’ve been thinking about starting a business. Maybe you’re freelancing, running an online shop, or offering consulting services. Whatever it is, you’re making money,…

You’ve been thinking about starting a business. Maybe you’re freelancing, running an online shop, or offering consulting services. Whatever it is, you’re making money,…

Running a small business means working hard to earn money, but keeping more of it is just as important. Taxes can take a big…

If you are a U.S. citizen or resident involved with a foreign corporation, you may need to file IRS Form 5471, even if the…

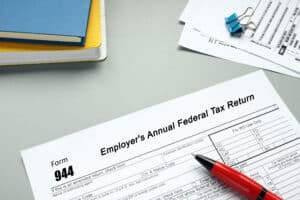

Running a business involves managing a packed schedule. Tax season adds to the workload with extra paperwork. If you’re among the ten percent of…

When it comes to running a business, staying on top of your tax responsibilities is crucial. If you’re a small-scale employer, chances are you…

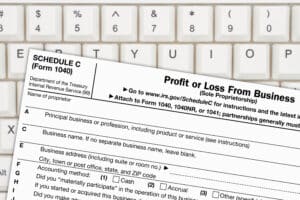

As a business owner, one of the most important financial responsibilities you will face is filing taxes. If you are running a Limited Liability…

Filing taxes can be overwhelming, especially for married couples when one spouse is a business owner. When tax season comes, couples must make a…

Seeking opportunities and experiences in other countries is one of the reasons why expats thrive elsewhere. Countries with booming economies attract expat entrepreneurs, but it can be quite a daunting task, especially if you want to build a business from scratch.

Understanding how the U.S. taxes foreign corporations can help you keep your business obligations in check. Learn more in this infographic.

Copyright © 2025 Tax Samaritan | All Rights Reserved | Privacy Policy

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Workflow Excellence Manager will lead the client service experience at Tax Samaritan. This role ensures clients receive unparalleled communication, seamless service delivery, and exceptional care aligned with our commitment to proactive and personalized tax solutions for U.S. expats.

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Transformation Success Manager plays a key role in delivering exceptional client experiences by building strong relationships and offering value-driven tax advisory and financial planning. This role ensures clients receive proactive, strategic guidance to achieve long-term financial success.