Back Taxes Defined: How to Overcome & Reasons Expats Need to File on Time

Paying taxes is an obligation every American must comply with. It’s something you shouldn’t try to ignore. When you attempt to get away from filing your tax returns or paying your taxes, the Internal Revenue Service (IRS) will come after you, and you may face sanctions. These sanctions may involve penalties and interest and may even result in the seizure of your property.

With the infographic below, you’ll get a good grasp of the consequences of failure to pay back taxes, the causes of back taxes, and the strategies you can use to settle your tax liability with the IRS.

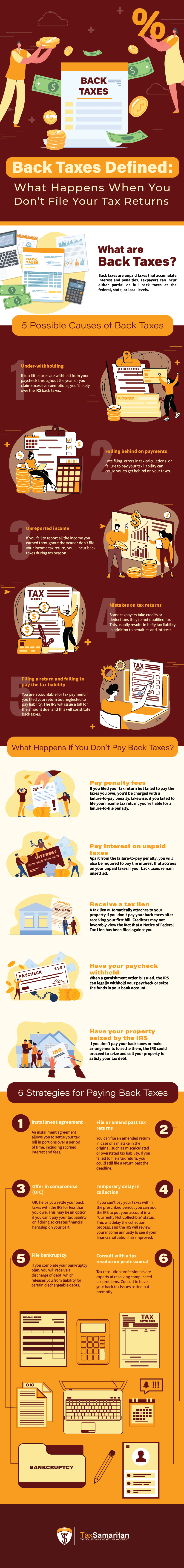

What are Back Taxes?

Back taxes are unpaid taxes that accumulate interest and penalties regularly. Taxpayers can incur either partial or full back taxes at the federal, state, or local levels. If back taxes remain unpaid, serious legal consequences can result, including tax liens, wage garnishment, or seizure of property.

5 Possible Causes of Back Taxes

People owe back taxes for various reasons. Here are some of the most common ones:

-

Under-withholding

The law requires employers to withhold taxes from their workers’ paychecks. However, if taxes withheld throughout the year are too little, the employee will owe the IRS back taxes come tax season. This is known as under-withholding. It can also happen when the employee claims excessive exemptions.

-

Falling behind on payments

People fall behind on their taxes for various reasons. It could be due to late filing, errors in tax calculations, or failure to pay their tax liability. Unless it’s due to financial hardship, the IRS will come after you for back taxes if you fail to pay. U.S. expats are prone to falling behind on payments, as the filing procedure tends to be more complicated for Americans living abroad.

-

Unreported income

If you fail to report all the income you earned throughout the year, you’ll incur back taxes. This is one of the most common mistakes expats make when it comes to filing taxes.

Likewise, if you neglect to file your income tax return, the IRS will have a reason to tag you for unreported income, prompting the agency to conduct an audit. Keep in mind that unreported income is a huge deal to the IRS, and if they suspect you owe a significant amount of income taxes, they won’t be shy about getting hold of you.

-

Mistakes on tax returns

Some taxpayers simply misunderstand the tax laws and take credits or deductions they’re not qualified to claim. This usually results in hefty tax liability, not to mention penalties and interests. For U.S. expats, this can present a more challenging situation, as tax filing for Americans working abroad proves to be more complex than the procedure for those who live in the U.S.

-

Filing a return and failing to pay the tax liability

Another reason people incur back taxes is that they fail to pay the taxes they owe. You are still accountable for tax payment if you filed your tax return but neglected to pay the tax liability. In this instance, the IRS will issue a bill for the amount due, which will constitute back taxes.

What Happens If You Don’t Pay Back Taxes?

Failure to pay back taxes can lead to penalties and legal actions. Here are the sanctions you may face when you neglect your tax liability:

-

Pay penalty fees

Whether you failed to pay your taxes or neglected to file your income tax return, you’re certain to face sanctions from the IRS. If you filed your tax return but failed to pay the taxes you owe, the IRS will charge you with failure-to-pay penalty. The fine is equivalent to 0.5% of your unpaid taxes for each month you didn’t settle your tax liability, up to five months out, or a total of 25%.

Likewise, if you failed to file your income tax return, you’d be subjected to a failure-to-file penalty. The penalty amounts to 5% of the tax you owe for each month your tax return is late. The maximum fine is 25%. If you filed your return more than 60 days late, you’d pay a minimum of $435 or 100% of your unpaid taxes, whichever is smaller.

-

Pay interest on unpaid taxes

Apart from facing a failure-to-pay penalty, you will also have to pay the interest that accrues on your unpaid taxes if your back taxes remain unsettled. The rate is determined by the federal short-term rate, or anywhere between 1% to 4%, plus 3%. That pegs the interest rate between a hefty 3% and 8%.

-

Receive a tax lien

A tax lien is a legal claim the IRS makes against all your current and future property. This may include your house and car, as well as rights you have to property. It automatically attaches to your property if you don’t pay your back taxes after receiving your first bill. Once the IRS issues a Notice of Federal Tax Lien against you, it may be reported by consumer credit reporting agencies.

This can impact your credit rating, making it difficult for you to get approved for a loan or credit card. Likewise, employers, landlords, and creditors may use the information to assess your ability to pay a loan or mortgage. With back taxes included on your credit report, they may not favorably view the fact that a Notice of Federal Tax Lien has been filed against you.

-

Have your paycheck withheld

Another possible consequence is garnishment. When a garnishment order is issued, the IRS can levy your wages and even your bank accounts. They can legally withhold your paycheck by directing your employer to remit a portion of your salary for a certain period until your unpaid taxes are settled.

The IRS can also seize the funds in your bank account by ordering the bank to turn over the funds available for withdrawal up to the amount of your unpaid taxes. The seizure will include any interest earned on the covered amount unless you have resolved the issue in another way.

-

Have your property seized by the IRS

If you don’t pay your back taxes or make arrangements to settle them, the IRS could seize your property. The IRS will first send you a bill containing your tax liability after assessing your tax return. If you refuse to pay the tax indicated on the bill, you will be issued a Final Notice of Intent to Levy.

You can request a Collection Due Process hearing within 30 days from the date of your Final Notice of Intent to Levy and Notice of Your Right to a Hearing. If the court determines that the levy is proper, the IRS will seize and sell your property to satisfy your tax debt.

6 Strategies for Paying Back Taxes

Taxpayers with back taxes have options in settling their tax liability. Here are some strategies to negotiate payments with the IRS:

-

Installment agreement

The IRS has a payment plan that allows you to settle your tax bill, including accrued interest and fees, as installments over a period of time. If you opt for this arrangement, it’s crucial that you don’t miss repayments and be proactive, as you’ll have a better chance of settling your back taxes and resolving your tax issues.

If you owe more than $25,000, the payment must be made via automatic withdrawals from a bank account. If you use a debit or credit card, you’ll have to pay a processing fee. This runs from $2 to $4 per transaction for debit cards and about 2% of the payment for credit cards.

-

File or amend past tax returns

Another way to settle back taxes is to file an amended return. This is appropriate when there is a mistake in your original tax return, such as miscalculated or overstated tax liability.

If the error was identified after the due date for filing your tax return, you are required to mail the amended tax return to the IRS. But if the filing date is not yet due, you should submit another original tax return with the proper information.

If you failed to file a tax return for a certain period, you could still file a return past the deadline. However, you’ll have to pay late filing interest and penalty charges. But if you are due a refund, the IRS will not penalize you for filing your tax return beyond the schedule.

-

Offer in compromise (OIC)

An offer in compromise helps you settle back taxes with the IRS for less than you owe. This may be an option if you absolutely can’t pay your tax liability. Or, if doing so creates financial hardship on your part. Generally, the higher your tax liability and the lower your ability to pay, the better a candidate you are for an OIC.

To qualify for this arrangement, you have to be compliant with the following criteria:

- You have no delinquent returns

- You are not in an open bankruptcy

- You made initial tax payments and deposits with the IRS

-

Temporary delay in collection

If you can’t reasonably pay your taxes within the prescribed period, you can ask the IRS to put your account in a “Currently Not Collectible” status to delay the collection process. This form of tax relief is temporary, and the IRS will review your income annually to see if your financial situation has improved.

To avail of this arrangement, you need to accomplish a Collection Information Statement form. You must provide information about your monthly income and expenses, on which the IRS will base its assessment on whether or not you’ll qualify for the status.

-

File bankruptcy

For individual taxpayers, the most common type of bankruptcy is Chapter 13, or the voluntary reorganization of debt for individuals. If you complete your Chapter 13 plan, you will receive a discharge of debt. This releases you from personal liability for certain dischargeable debts.

To take full advantage of the bankruptcy plan, you must not continue to incur additional tax debt while in bankruptcy.

-

Consult with a tax resolution professional

Tax resolution professionals are experts at resolving complicated tax problems. They have extensive experience working on IRS tools and processes. This includes OIC, installment agreements, and other tax penalty abatement procedures. By consulting with a tax resolution specialist, you can have your back tax issues sorted out, helping you settle your tax liability promptly.

Settling Your Back Taxes

There are several reasons taxpayers incur back taxes. The most common is failure to file tax returns and neglecting to pay the taxes owed.

When unsettled, back taxes can result in serious legal actions, including tax liens, seizure of property, and wage garnishment. The good news is that the IRS offers arrangements to help taxpayers reduce their tax liabilities.

If you incurred back taxes and need help sorting out your tax liability, Tax Samaritan can provide expert assistance. We offer professional and quality tax resolution services designed for expats like you. Serving expats since 1997, we’re here to help resolve your tax problems and minimize risks.