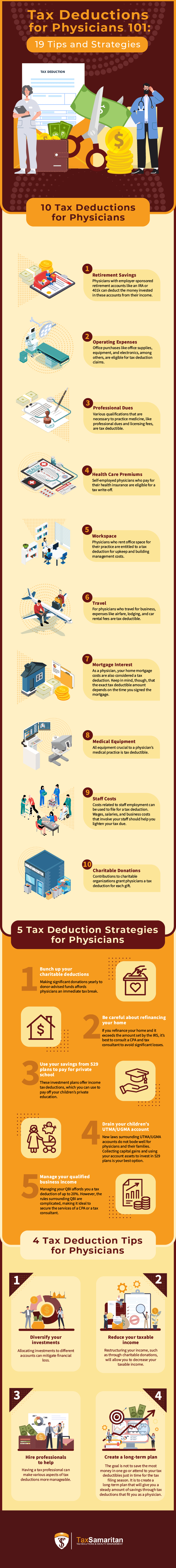

Valuable Tax Deductions for Physicians You Need To Know

While physicians in the U.S. earn high salaries, they also pay higher taxes. However, some physicians are oblivious to tax deductions that can benefit them. Tax deductions are excellent ways to reduce taxes and save money.

If you want to know how the government taxes physicians, this infographic will help you identify the tax deductions for physicians as well as some tips and strategies on how to maximize them.

10 Tax Deductions for Physicians

Doctors, whether self-employed or otherwise, can reduce their taxable income by leveraging these tax breaks.

1. Retirement Savings

You are entitled to a tax deduction if you’re a physician with employer-sponsored retirement accounts like an Individual Retirement Account (IRA) or 401k.

By deducting the money saved in these accounts, you can reduce your taxable income and consequently avoid high tax rates. With the IRS imposing new IRA contributions yearly, it’s best to save the most money possible.

2. Operating Expenses

Self-employed physicians typically purchase office equipment, supplies, computers, and phones, among other things, for their private practice. In the past, regulations did not allow for home office tax deductions.

Fortunately, these relevant business expenses are now considered tax write-offs. You only need to keep track of all costs for every purchase to ensure you can claim every eligible expense.

3. Professional Dues

To practice in the medical profession, physicians must settle various professional dues and licensing fees, which are tax deductible. These expenses include but are not limited to medical license renewal, membership, and education costs.

And since physicians must stay updated on medical field developments to elevate the quality of their service, any expenses related to education, professional development, and even subscriptions to professional or technical publications are deductible.

4. Health Care Premiums

Employers normally pay all health care premiums for their physicians. However, if you’re a self-employed physician paying for your health insurance, you can categorize health premiums as tax-deductible business expenses.

For instance, a Health Savings Account (HSA) lets you make tax-free contributions for health care expenses. If you have an HSA, saving more in this account is a great way to safeguard your money from taxation.

5. Workspace

Physicians in private practice typically rent a building or office space for work. This entitles them to space-related tax deductions since upkeep and building management costs are deductible, along with utilities, rent, and other office costs. It’s ideal to constantly track all these expenses so you can report them on your tax return.

6. Travel

If you constantly travel for seminars, conferences, and other events related to conducting your work as a doctor, you can claim most of your travel expenses as business expenses. These include airfare, rented vehicles, and lodging. You must report them on your tax returns to deduct them from your taxable income.

7. Mortgage Interest

When preparing your tax returns, consider your home mortgage costs. Home mortgage interests are claimable tax deductions, another way you can greatly save money on your tax dues.

The exact tax deductible amount will vary depending on the time you signed the mortgage. If you purchased the property after Dec. 15, 2017, you could deduct interest on the first $750,000 of your mortgage debt.

8. Medical Equipment

The equipment you use to properly conduct your work will likely be a tax-deductible business expense. In general, medical equipment is generally more expensive than equipment in other industries. As such, it is often a prime source of tax deductions. Purchasing medical devices and supplies will allow you to claim all the money spent on them as a tax deduction.

9. Staff Costs

If you employ staff to help you with medical work, their wages and salaries may also be tax-deductible expenses. Since you spend money on business expenses like employee benefits and other costs related to their employment, you may be entitled to a sizable tax write-off.

10. Charitable Donations

Physicians who consistently make charitable contributions can expect significant tax deductibles, as well. These donations will allow you to deduct qualifying contributions up to your total adjusted gross income for the current year, effectively reducing your tax burden.

5 Tax Deduction Strategies for Physicians

1. Bunch up your charitable deductions

If you consistently make small charitable donations, you may not be able to fully benefit from them. However, you can remedy this by donating one large sum annually, specifically appreciated securities, to public charity accounts.

Donors who make charitable contributions to these donor-advised funds receive an immediate tax deduction and are allowed to recommend grants from the fund in the future.

2. Be careful about refinancing your home

Per Publication 936 of the Internal Revenue Service (IRS), only the interest on the first $750,000 of indebtedness is deductible. The amount is even lower at $375,000 if you are married and filing taxes separately. Plus, you can only deduct interest on home equity for home improvements or new property purchases.

3. Utilize your savings from 529 plans to pay for private school

A 529 college savings plan is a state-sponsored investment plan that allows an individual to save money for a beneficiary and pay for education costs. The investment plan will enable the enrollee to withdraw funds tax-free to pay off almost any type of college expense along with otherfederal or state tax benefits.

With the inclusion of the “Tax Cuts and Jobs Act” (TCJA) provision, physician families can now utilize Section 529 assets to cover the cost of private K-12 schooling up to $10,000 yearly per child.

Given that multiple states offer 529 tax write-offs, you can invest money into a 529 plan and use it to pay for your children’s or grandchildren’s private education.

4. Drain your children’s UTMA/UGMA account

The Uniform Gifts to Minors Act (UTMA) or the Uniform Transfers to Minors Act are custodial accounts that let you transfer financial assets to a minor without the need for a trust.

Unfortunately, the way these accounts work means only the initial $2,600 of capital gains is tax-free. The ordinary income is taxable, as well. It might be better to collect capital gains up to the limit, spend the UTMA assets, and use any remaining cash to invest in a 529 plan instead.

5. Manage your qualified business income

Qualified business income (QBI) is a form of tax deduction that allows eligible taxpayers to deduct up to 20% of their QBI on their taxes.

While this is a significant tax write-off most physicians wouldn’t want to neglect, the rules surrounding QBI can be complicated. As far as QBI is concerned, a CPA or tax consultant can help in making assessments correctly.

4 Tax Deduction Tips for Physicians

1. Diversify your investments

Diversifying your investments can put you in an ideal financial situation. To accomplish this, start by checking your tax-favored, tax-deferred, and taxable accounts. Once you’ve done that, you can proceed to spread investments between these accounts.

Allocating investments across different accounts, industries, and other categories can decrease your chances of financial loss.

For instance, solely relying on your IRA or 401k and other tax-deferred items can only benefit you for so long. While these are crucial aspects of your portfolio, they offer limited tax flexibility.

2. Reduce your taxable income

Reducing the amount of money you have to pay taxes on has a direct positive effect on your tax deductions. This only takes a simple restructuring of your contributions and income. One excellent way to reduce your taxable income is by making charitable donations since you will get a tax deduction for every gift.

3. Hire professionals to help

Tax reduction can be difficult for many taxpayers. However, hiring a tax professional to help you can make achieving the goal easier. Your hired tax expert will aid you in creating a financial plan focused on diversifying your investments, reducing taxable income, and solving tax burdens for the long term.

Your accountant or tax consultant will also help you oversee all your expenses during the year and look for ways to maximize all forms of tax deductions.

Additionally, since tax professionals are experts in tax-related laws, they can provide proper guidance and offer options so you can consistently save money and strengthen your financial status.

4. Create a long-term plan

While saving as much money as possible is the ideal outcome when exploring various tax deduction strategies, creating a long-term plan is still vital. A long-term plan will ensure you can retain and even grow your earnings throughout your physician career.

Putting Your Trust in Tax Deduction

Physicians have highly challenging jobs, not to mention among the highest-paying ones. As such, knowing the different tax deductions available and their benefits is vital in keeping your tax dues at acceptable levels.

If you need a reliable tax resolution partner, Tax Samaritan offers the best-in-class service. Helping expats save money since 1997, Tax Samaritan understands all the intricate tax laws whether you’re an expat or a physician looking to pay taxes truthfully and rightfully. Contact us today and get a free tax quote.