5 Simple Steps to Fix Rejected Tax Returns for Expats

You spent days, perhaps even months, wrestling with receipts, forms, and numbers to prepare your tax return. After countless hours of hard work, you…

You spent days, perhaps even months, wrestling with receipts, forms, and numbers to prepare your tax return. After countless hours of hard work, you…

You go through your day’s mail at your kitchen table. Among the usual bills and ads, a letter catches your attention—it’s from the IRS. …

Earning a high income has advantages, but it can also put you in a higher tax bracket. This means the government takes more of…

It’s tax season again, and many ask, “Will the IRS take my refund for my student loan in 2024?” Tax refunds can be a…

Here’s one of the most frequent questions people ask me about back taxes. “Can the IRS garnish my pension to compensate for back taxes?”…

Taxpayers often get confused with the terms tax avoidance and tax evasion. While they both involve reducing your tax burden, they have different meanings…

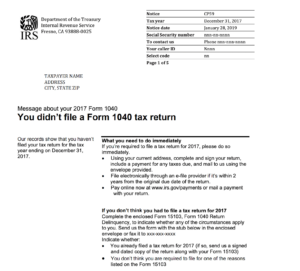

If you’ve been neglecting your obligation to file your U.S. tax returns, you will likely receive an IRS CP59 notice. Receiving the letter requires…

Here’s one of the most frequent questions people ask me about Foreign Bank Account Reports (FBARs). ‘‘I recently learned about the need to file…

Here’s one of the most frequently asked questions I receive about 401(K) withdrawal. ”I recently lost my job, and unfortunately, I don’t have an…

Copyright © 2025 Tax Samaritan | All Rights Reserved | Privacy Policy

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Workflow Excellence Manager will lead the client service experience at Tax Samaritan. This role ensures clients receive unparalleled communication, seamless service delivery, and exceptional care aligned with our commitment to proactive and personalized tax solutions for U.S. expats.

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Transformation Success Manager plays a key role in delivering exceptional client experiences by building strong relationships and offering value-driven tax advisory and financial planning. This role ensures clients receive proactive, strategic guidance to achieve long-term financial success.