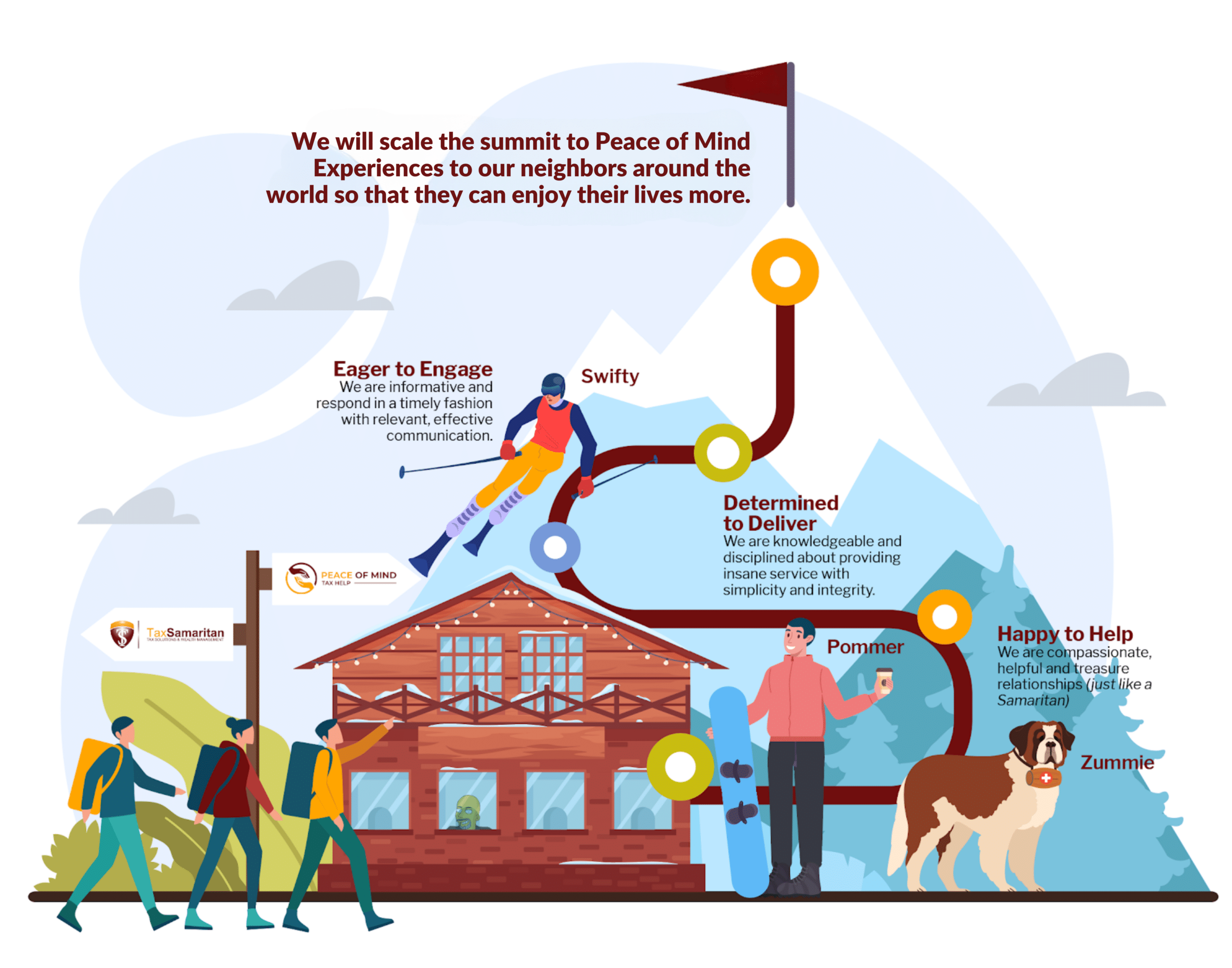

Our core Values

At Tax Samaritan, we firmly recognize the significance of clearly articulating our core values, as they form the very essence of our culture, shape our brand identity, and serve as the driving force behind our strategic decisions. These fundamental principles serve as our compass, guiding every decision and action we undertake, ultimately allowing us to provide unparalleled service and support to our valued clients.

Determine to Deliver

We are knowledgeable and disciplined about providing insane service with simplicity and integrity.

Eager to Engage

We are informative and respond in a timely fashion with relevant, effective communication.

Happy to Help

We are compassionate, helpful and treasure relationship (just like a Samaritan)

We Are The U.S. Tax Safety Experts. We Eliminate U.S. Expat Tax Risks

Get Clear Tax Advice That Makes A True Difference

What to Expect?

Meet The Tax Samaritan Owners

Tax expert Randall Brody is the founder of Tax Samaritan and Peace Of Mind Help, companies specializing in expatriate tax solutions and tax resolution. With his Enrolled Agent (EA) designation from the Internal Revenue Service, Randall helps clients solve complex tax problems and alleviate their stress and fear.

Brody has been published in the EA Journal, the industry magazine for the National Association of Enrolled Agents. For over 30 years, he has guided over 9,500 taxpayers and eliminated more than $800 million in tax debt.

He lives in North Las Vegas, Nev. with his wife, Connie, and their giant dogs Gracie, a Labradoodle; Scoobie, a Great Dane; and Zummie, a St. Berdoodle. The Brodfs have five children and six grandchildren.

Randall Brody

Tax Samaritan Founder and CEO

Connie Brody

Tax Samaritan Office Coach And Co-Owner

After over 20 years as a Regional Manager in the healthcare and per diem staffing industry for medical staff, Connie decided to join her husband Randall to help build a tax preparation and resolution firm focused on the needs of U.S. expats. Connie spends her days ensuring that Tax Samaritan offers exactly what our clients need and help them through the process of gathering the information needed for their return preparation.

On a personal note, Connie loves spending time with her large family (husband„. yes.„ even though sometimes working side-by-side with one’s spouse can be a bit overwhelming at times.„, four daughters, son, granddaughter and grandsons).

Our Accreditations and Awards

We are proud to be recognized by the Most trusted Firms in the world.

Why Tax Samaritan

With so many tax preparation firms, why should you choose us?

Talk To An Expert

Ready to start saving money on your taxes? Please click the button below to talk to one of our expat tax experts. We are also available to discuss any other tax or planning concerns you may have.